FREE INFOGRAPHIC

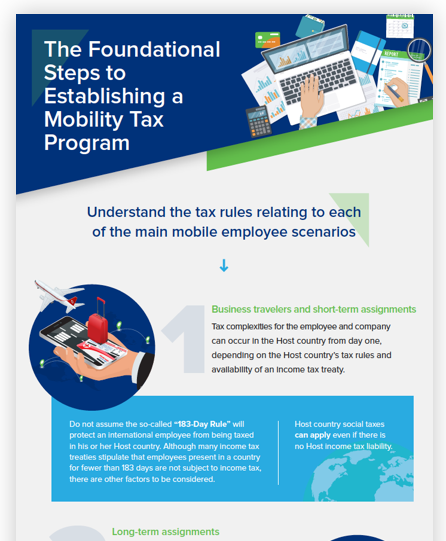

5 Essential Steps for Establishing a Mobility Tax Program

If you’re managing international employees, establishing a mobility program that handles the complex nature of global tax is critical to the success of you and your team. Download your copy of our infographic to learn how you can establish an agile program that effectively handles mobility tax situations around the globe.